Precious Metal Investment Information

When it comes to investments, one of the most attractive options available today is a precious metals investment. Read on to learn more about precious metals investing see if it is for you and why you should consider adding it to your portfolio.

Types of Precious Metals

Platinum

Palladium

If you are looking to diversify your portfolio by adding precious metals there are various investment options to consider. You might decide to invest in one precious metal or several, through a tax deferred retirement account, or by purchasing bullion metal directly. Learning as much as possible about type of precious metals is a good idea before making your decision.

Common Precious Metals Questions

Our retirement experts get lots of questions from curious investors. Here are some common questions and answers about precious metals:

At the most basic level, investors need to understand the terminology used for precious metals. No question is more foundational to precious metal investing than understanding exactly what is meant by the term bullion. In short, gold bullion comes in the form of bars or coins and must meet certain purity standards to be permissible in a retirement account. Gold bullion allows you to own physical gold that can be stored and liquidated at your discretion. Read these article to learn more:

I am text block. Click edit button to change this text. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

I am text block. Click edit button to change this text. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

I am text block. Click edit button to change this text. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Precious Metal IRAs

There are a variety of precious metal IRAs available today from which to choose. Gold is the most popular type of precious metal IRA for numerous reasons. If you’re interested in owning gold, a self-directed IRA is the way to do it. Owning physical gold outside of an IRA also has its own advantages; but owning both is a great strategy for creating a diverse long-term investment portfolio.

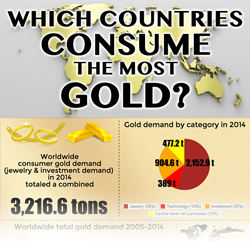

Infographics